Stellantis Car Finance: Your Ultimate Guide To Drive Your Dreams

Buying a car is one of life’s biggest decisions, and Stellantis Car Finance can make it smoother than ever. Whether you're dreaming of a Jeep Wrangler or a Peugeot 208, this finance option opens doors you might not have thought possible. It’s not just about getting a car; it’s about securing the right deal that fits your budget and lifestyle. Stellantis Car Finance has become a buzzword in the automotive industry, and we’re here to break it down for you.

Let’s be honest, buying a car isn’t just about the car itself. It’s about the financial plan that makes it all possible. Stellantis Car Finance offers a range of options that cater to different needs, from personal loans to lease agreements. This article dives deep into how Stellantis Car Finance works, its benefits, and why it’s worth considering when you’re ready to hit the road.

Before we dive in, let’s address the elephant in the room: money. Stellantis Car Finance isn’t just another financial product. It’s a tailored solution designed to fit your wallet, your schedule, and your dream car. So, buckle up and let’s explore how you can turn your car dreams into reality.

What is Stellantis Car Finance?

Stellantis Car Finance is the financial arm of Stellantis, one of the world’s largest automakers. It provides a variety of financing options to help customers buy or lease vehicles from brands like Jeep, Dodge, Chrysler, Citroën, Peugeot, and more. Think of it as a one-stop shop for all things car finance under the Stellantis umbrella.

Here’s the kicker: Stellantis Car Finance isn’t just about lending money. It’s about offering flexible terms, competitive rates, and personalized solutions that make car ownership accessible to more people. Whether you’re buying a brand-new vehicle or opting for a pre-owned gem, Stellantis has got you covered.

Key Features of Stellantis Car Finance

- Competitive Interest Rates: Stellantis offers some of the lowest rates in the industry, making it easier for customers to afford their dream cars.

- Flexible Terms: Choose from a variety of repayment periods, from 24 to 72 months, depending on what works best for your budget.

- Customizable Options: Tailor your finance plan to fit your lifestyle, whether you prefer a lease or a loan.

- Wide Range of Vehicles: With Stellantis owning 14 automotive brands, the options are endless. From SUVs to sedans, there’s something for everyone.

Why Choose Stellantis Car Finance?

Now, you might be wondering, “Why should I choose Stellantis over other financing options?” Well, here’s the deal: Stellantis Car Finance isn’t just about numbers. It’s about trust, reliability, and a commitment to customer satisfaction. Let’s break it down:

First off, Stellantis has a proven track record of delivering quality products. When you finance a car through Stellantis, you’re not just getting a loan—you’re getting access to a network of trusted dealerships, top-notch customer service, and a brand that stands behind its promises. Plus, the convenience factor can’t be overstated. With Stellantis, everything is streamlined, from the application process to the final paperwork.

Benefits of Stellantis Car Finance

- Convenience: Apply online or in-person at your local dealership. The process is simple, fast, and hassle-free.

- Customer Support: Stellantis offers 24/7 customer service, so you’ll never be left in the dark if you have questions or concerns.

- Exclusive Offers: As a Stellantis customer, you’ll often have access to special promotions, discounts, and incentives that aren’t available elsewhere.

How Does Stellantis Car Finance Work?

Alright, let’s get into the nitty-gritty of how Stellantis Car Finance actually works. The process is surprisingly straightforward, and here’s how it goes:

- Choose Your Vehicle: Start by picking out the car of your dreams from any of the Stellantis brands.

- Apply for Financing: You can apply online or at your local dealership. The application process is quick and easy, and you’ll usually get a decision within minutes.

- Review Your Options: Once approved, Stellantis will present you with a range of financing options, including loans and leases. You’ll be able to choose the one that best fits your needs.

- Sign the Papers: After you’ve made your decision, it’s time to finalize the deal. Sign the paperwork, and you’ll be driving off in your new car in no time.

It’s worth noting that Stellantis Car Finance offers both direct and indirect lending options. Direct lending means you work directly with Stellantis, while indirect lending involves going through a dealership. Both options have their pros and cons, so it’s important to weigh them carefully before making a decision.

Loan vs Lease: Which is Right for You?

When it comes to Stellantis Car Finance, one of the biggest decisions you’ll face is whether to opt for a loan or a lease. Here’s a quick breakdown:

- Loan: With a loan, you own the car outright once you’ve paid off the balance. This is a great option if you want to keep your car long-term and build equity.

- Lease: A lease allows you to drive a new car every few years without the commitment of ownership. It’s perfect for those who want the latest models without the hassle of selling or trading in their old cars.

Ultimately, the choice comes down to your personal preferences and financial situation. Stellantis Car Finance makes it easy to explore both options so you can make an informed decision.

Stellantis Car Finance Rates and Terms

One of the biggest draws of Stellantis Car Finance is its competitive rates and flexible terms. But what exactly does that mean for you? Let’s take a closer look:

Interest rates for Stellantis Car Finance vary based on factors like credit score, loan amount, and repayment period. However, Stellantis consistently offers some of the lowest rates in the industry, which can save you thousands over the life of your loan. As for terms, Stellantis offers repayment periods ranging from 24 to 72 months, giving you the flexibility to choose a plan that fits your budget.

Factors Affecting Your Interest Rate

- Credit Score: A higher credit score typically results in a lower interest rate.

- Loan Amount: Larger loans may come with slightly higher rates, but Stellantis still offers competitive pricing.

- Repayment Period: Longer repayment periods usually mean higher interest rates, but they also lower your monthly payments.

It’s important to note that Stellantis Car Finance offers pre-approval options, allowing you to lock in a rate before you even start shopping for a car. This can give you a better idea of what you can afford and make the buying process smoother.

Stellantis Car Finance Customer Reviews

What do real customers have to say about Stellantis Car Finance? The reviews are overwhelmingly positive. Many customers appreciate the ease of the application process, the transparency of the terms, and the reliability of the service. Here are a few highlights:

“I was blown away by how easy it was to get approved for a loan through Stellantis. The rates were unbeatable, and the customer service was top-notch.”

“Leasing through Stellantis has been a game-changer for me. I love being able to drive a new car every few years without the hassle of selling my old one.”

Of course, like any financial product, there are always a few downsides. Some customers have noted that the application process can be slightly slower during peak times, but overall, the positives far outweigh the negatives.

Common Questions About Stellantis Car Finance

- Can I finance a used car with Stellantis Car Finance? Absolutely! Stellantis offers financing options for both new and pre-owned vehicles.

- What if I have bad credit? Stellantis works with customers of all credit levels to find a financing solution that works for them.

- Is there a penalty for paying off my loan early? No, Stellantis does not charge prepayment penalties, so you can pay off your loan early without any extra fees.

Stellantis Car Finance vs Competitors

How does Stellantis Car Finance stack up against other financing options? Let’s compare:

Compared to traditional banks and credit unions, Stellantis Car Finance often offers more competitive rates and flexible terms. Plus, the convenience of working with a single entity—both for the car and the financing—can’t be beat. When it comes to other automakers’ finance arms, Stellantis holds its own, offering similar or better rates and terms.

What Sets Stellantis Apart?

- Wide Range of Vehicles: With 14 brands under its belt, Stellantis offers more options than most competitors.

- Customer-Centric Approach: Stellantis prioritizes customer satisfaction, offering personalized solutions and 24/7 support.

- Exclusive Promotions: Stellantis frequently runs special offers and incentives that aren’t available through other lenders.

Stellantis Car Finance in the Market

As the automotive industry continues to evolve, Stellantis Car Finance remains at the forefront of innovation. With a focus on digital transformation, Stellantis is making it easier than ever for customers to apply for financing, track their loans, and manage their accounts online.

In addition, Stellantis is committed to sustainability, offering financing options for electric and hybrid vehicles as part of its broader environmental initiatives. This aligns with the growing demand for eco-friendly transportation solutions and positions Stellantis as a leader in the green revolution.

The Future of Stellantis Car Finance

Looking ahead, Stellantis Car Finance is poised for even greater success. With plans to expand its digital capabilities, introduce new financing products, and enhance customer experiences, the future looks bright. Stellantis is also investing heavily in research and development to stay ahead of the curve in terms of technology and innovation.

Conclusion

In conclusion, Stellantis Car Finance offers a comprehensive and customer-focused approach to automotive financing. Whether you’re buying a new car, leasing a luxury vehicle, or financing a pre-owned gem, Stellantis has the tools and expertise to make it happen. With competitive rates, flexible terms, and a commitment to customer satisfaction, Stellantis Car Finance is a smart choice for anyone in the market for a new ride.

So, what are you waiting for? Head over to your local Stellantis dealership or apply online today to see what Stellantis Car Finance can do for you. And don’t forget to share this article with your friends and family who might be in the market for a new car. Together, let’s drive the future of automotive finance!

Table of Contents

- What is Stellantis Car Finance?

- Why Choose Stellantis Car Finance?

- How Does Stellantis Car Finance Work?

- Stellantis Car Finance Rates and Terms

- Stellantis Car Finance Customer Reviews

- Stellantis Car Finance vs Competitors

- Stellantis Car Finance in the Market

- The Future of Stellantis Car Finance

- Conclusion

Stellantis Finance Unit Ramps Up Dealer Ops Auto Dealer Today

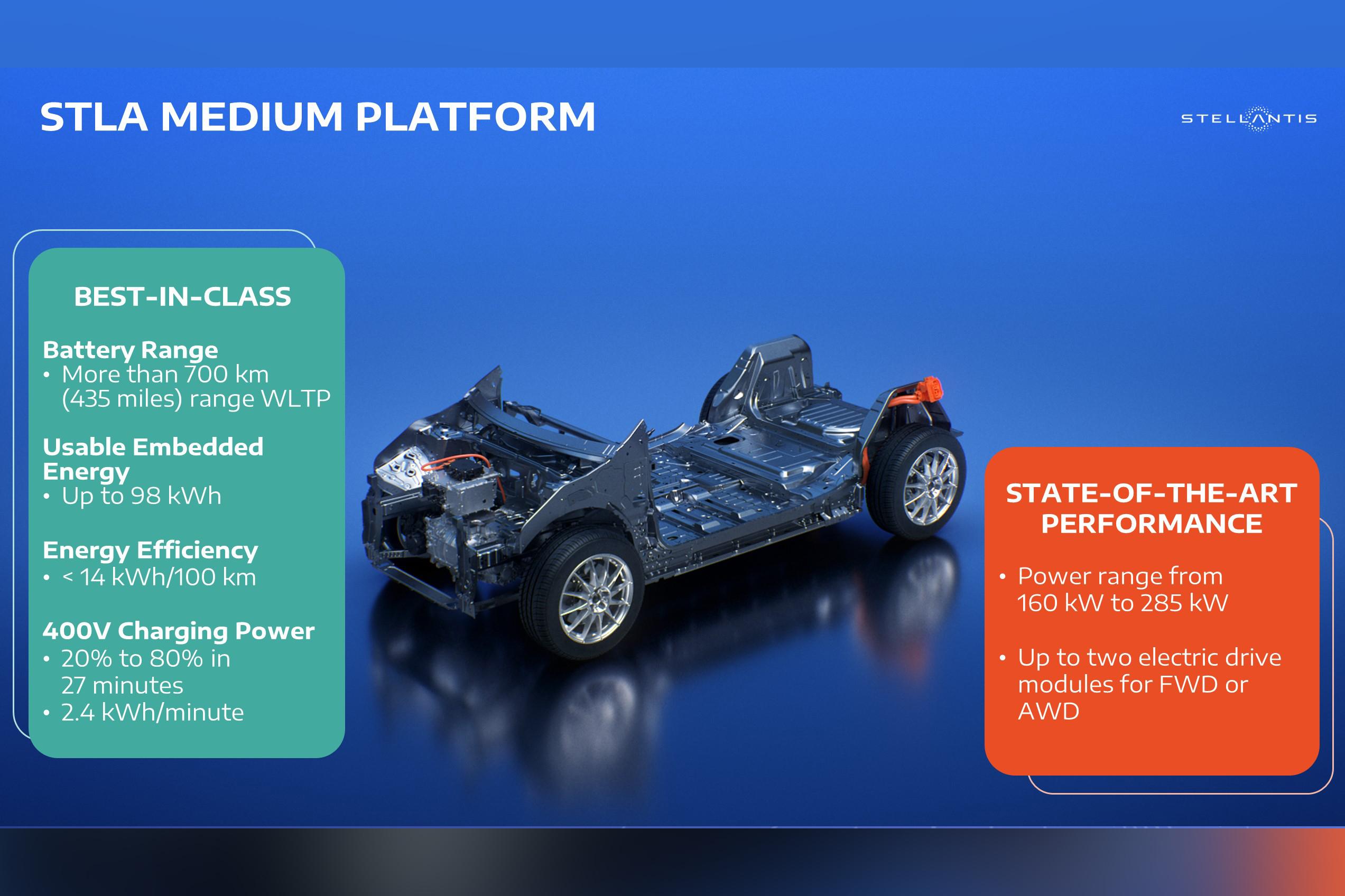

Stellantis targeting heart of the market with new electric car platform

Stellantis cars.................. Which Mobility Car Forum