What Are Quota Rents: A Comprehensive Guide To Understanding Their Impact

**Ever wondered what are quota rents and why they matter so much in economics and trade?** Quota rents are a concept that often gets overlooked but plays a significant role in global trade dynamics. Whether you're an economist, a business owner, or just someone curious about how international trade works, understanding quota rents is crucial. In simple terms, quota rents refer to the additional profits or benefits that arise when a quota is imposed on the import or export of goods. But there's so much more to it than just a definition. Let's dive in and explore what quota rents really mean, their implications, and why they matter to you.

Quota rents might sound like a complex economic term, but they're actually quite straightforward once you break them down. Essentially, when governments impose limits on how much of a particular good can be imported or exported, it creates a scarcity. This scarcity leads to opportunities for those who can secure access to the limited supply, resulting in extra profits—these are what we call quota rents. It's like having a golden ticket to a highly sought-after event; if you've got it, you're in a great position to benefit.

So, why should you care about quota rents? Well, whether you're directly involved in international trade or not, the effects of quota rents can trickle down to everyday consumers. They influence prices, availability, and even competition in the market. Understanding this concept can help you make more informed decisions, whether you're running a business or simply shopping for groceries. Let's take a closer look at what quota rents are all about and why they're such a big deal in the world of economics.

Understanding the Basics of Quota Rents

To truly grasp what are quota rents, we need to start with the basics. A quota is essentially a limit placed by a government on the quantity of a particular good that can be imported or exported during a specific period. When a quota is imposed, it creates a situation where demand exceeds supply, leading to higher prices for the limited goods available. The extra profit that producers or traders make from selling these goods at higher prices is what we refer to as quota rents.

For example, imagine a country imposes a quota on the import of sugar. Only a certain amount of sugar can enter the country, making it scarce. As a result, the price of sugar rises, and those who manage to secure the limited supply can sell it at a higher price, earning additional profits. These profits are the quota rents. It's a simple concept, but one with far-reaching implications for both producers and consumers.

Quota rents are not just about profits; they also affect market dynamics. They can lead to inefficiencies, as the limited supply might not reach the most efficient producers or consumers. Additionally, quota rents can create opportunities for corruption, as individuals or companies might try to secure access to the limited supply through unethical means. Understanding these dynamics is crucial for anyone looking to navigate the complexities of international trade.

How Do Quota Rents Work in Practice?

Now that we've covered the basics, let's explore how quota rents work in real-world scenarios. When a government imposes a quota, it essentially creates a bottleneck in the market. This bottleneck can lead to various outcomes, depending on how the quota is managed and who has access to the limited supply. For instance, in the case of agricultural products, quotas can lead to higher prices for consumers, reduced competition, and even changes in production patterns.

Take the example of the United States imposing quotas on sugar imports. This quota limits the amount of sugar that can be imported, driving up domestic sugar prices. As a result, domestic sugar producers benefit from higher prices, earning additional profits—or quota rents. However, this comes at a cost to consumers, who end up paying more for sugar and sugar-based products. It's a classic case of trade-offs, where the benefits to one group come at the expense of another.

Quota rents can also lead to inefficiencies in the market. When a quota is in place, the limited supply might not reach the most efficient producers or consumers. This can result in a misallocation of resources, where less efficient producers or consumers end up benefiting from the quota rents. Additionally, quota systems can create opportunities for corruption, as individuals or companies might try to secure access to the limited supply through unethical means. These are just a few examples of how quota rents work in practice and the potential challenges they can create.

Types of Quotas and Their Effects on Quota Rents

Not all quotas are created equal, and different types of quotas can have varying effects on quota rents. There are two main types of quotas: absolute quotas and tariff-rate quotas. Absolute quotas set a strict limit on the quantity of a good that can be imported or exported, while tariff-rate quotas allow for a certain amount of imports at a reduced tariff rate, with higher tariffs applied to any additional imports beyond that limit.

Absolute quotas tend to create more pronounced quota rents, as the limited supply is strictly controlled. This can lead to higher prices and greater profits for those who secure access to the limited supply. On the other hand, tariff-rate quotas can create a more nuanced situation, where the initial imports benefit from reduced tariffs, but any additional imports face higher tariffs, potentially limiting the extent of quota rents.

Understanding the differences between these types of quotas is essential for grasping their impact on quota rents. It also highlights the importance of careful policy design to ensure that quotas achieve their intended goals without creating excessive distortions in the market. Whether you're a policymaker, a business owner, or a consumer, knowing how different types of quotas affect quota rents can help you make more informed decisions.

The Economic Implications of Quota Rents

Quota rents have significant economic implications that extend beyond just the immediate profits they generate. They can influence market dynamics, affect competition, and even impact long-term economic growth. When quotas are imposed, they create a situation where a select few benefit from the limited supply, often at the expense of the broader market. This can lead to inefficiencies, reduced competition, and even barriers to entry for new players in the market.

One of the key economic implications of quota rents is their impact on resource allocation. When a quota is in place, the limited supply might not reach the most efficient producers or consumers. This can result in a misallocation of resources, where less efficient producers or consumers end up benefiting from the quota rents. Over time, this can stifle innovation and reduce overall economic efficiency.

Additionally, quota rents can create barriers to entry for new players in the market. When a few established players control access to the limited supply, it can be difficult for new entrants to compete. This lack of competition can lead to higher prices, reduced quality, and fewer choices for consumers. Understanding these economic implications is crucial for anyone looking to navigate the complexities of international trade and its impact on the broader economy.

Quota Rents and Market Distortions

Quota rents can lead to significant market distortions, affecting everything from prices to competition. When a quota is imposed, it creates a situation where the market no longer operates under normal supply and demand conditions. Instead, the limited supply and higher prices can lead to inefficiencies, reduced competition, and even changes in production patterns.

For example, in the case of agricultural products, quotas can lead to higher prices for consumers, reduced competition, and even changes in production patterns. Farmers might shift their focus to producing goods that benefit from quota rents, even if it's not the most efficient use of their resources. This can lead to a misallocation of resources and reduced overall efficiency in the market.

Quota rents can also create opportunities for corruption, as individuals or companies might try to secure access to the limited supply through unethical means. This can further distort the market, leading to even greater inefficiencies and reduced competition. Understanding these market distortions is essential for anyone looking to navigate the complexities of international trade and its impact on the broader economy.

Quota Rents and Consumer Welfare

While quota rents can generate significant profits for producers and traders, their impact on consumer welfare is often less positive. When quotas are imposed, they can lead to higher prices, reduced competition, and fewer choices for consumers. This can result in a decrease in consumer welfare, as consumers end up paying more for goods and services while having fewer options to choose from.

For example, in the case of sugar quotas, consumers might end up paying higher prices for sugar and sugar-based products, such as candy and baked goods. This can have a significant impact on household budgets, especially for low-income families who spend a larger proportion of their income on food. Additionally, the reduced competition and limited supply can lead to lower quality goods and fewer choices for consumers.

Understanding the impact of quota rents on consumer welfare is crucial for anyone looking to navigate the complexities of international trade and its impact on everyday life. Whether you're a policymaker, a business owner, or a consumer, knowing how quota rents affect consumer welfare can help you make more informed decisions.

Strategies to Mitigate the Negative Effects of Quota Rents

While quota rents can have significant negative effects on consumer welfare, there are strategies that can be employed to mitigate these effects. Policymakers can design quota systems that promote competition, ensure fair access to the limited supply, and minimize opportunities for corruption. This can be achieved through careful policy design, transparent allocation mechanisms, and effective enforcement.

For example, governments can implement auctions or tendering processes to allocate the limited supply under a quota. This can help ensure that access to the limited supply is granted to the most efficient producers or traders, reducing the potential for inefficiencies and corruption. Additionally, policymakers can monitor the market closely to ensure that the quota system is achieving its intended goals without creating excessive distortions.

Businesses can also play a role in mitigating the negative effects of quota rents by promoting transparency, ensuring fair competition, and investing in innovation. By doing so, they can help reduce the potential for inefficiencies and ensure that the benefits of quota rents are shared more equitably among all stakeholders.

Quota Rents in Global Trade Agreements

Quota rents play a significant role in global trade agreements, influencing negotiations and shaping the terms of trade between countries. When countries negotiate trade agreements, they often include provisions for quotas, which can have a major impact on the distribution of quota rents. These provisions can determine who benefits from the limited supply, how the quota is allocated, and what safeguards are in place to prevent abuse.

For example, in the World Trade Organization (WTO), countries often negotiate quotas as part of their trade agreements. These quotas can be used to protect domestic industries, ensure fair competition, and promote economic development. However, they can also lead to inefficiencies, reduced competition, and even trade disputes if not carefully managed.

Understanding the role of quota rents in global trade agreements is essential for anyone looking to navigate the complexities of international trade. Whether you're a policymaker, a business owner, or a consumer, knowing how quota rents affect global trade agreements can help you make more informed decisions and advocate for fair and equitable trade practices.

Challenges and Opportunities in Managing Quota Rents

Managing quota rents presents both challenges and opportunities for policymakers, businesses, and consumers. On the one hand, quotas can be used to protect domestic industries, ensure fair competition, and promote economic development. On the other hand, they can lead to inefficiencies, reduced competition, and even trade disputes if not carefully managed.

One of the key challenges in managing quota rents is ensuring that the quota system achieves its intended goals without creating excessive distortions in the market. This requires careful policy design, transparent allocation mechanisms, and effective enforcement. Additionally, policymakers must balance the interests of various stakeholders, including producers, traders, and consumers, to ensure that the benefits of quota rents are shared equitably.

Despite these challenges, there are opportunities to use quota rents to promote economic development and social welfare. By designing quota systems that promote competition, ensure fair access to the limited supply, and minimize opportunities for corruption, policymakers can help reduce inefficiencies and ensure that the benefits of quota rents are shared more equitably among all stakeholders.

Case Studies: Real-World Examples of Quota Rents

To better understand the impact of quota rents, let's take a look at some real-world examples. These case studies highlight the complexities of quota rents and their impact on various stakeholders, from producers and traders to consumers and policymakers.

One notable example is the United States' sugar quota system. By imposing strict limits on sugar imports, the U.S. government has created a situation where domestic sugar producers benefit from higher prices, earning significant quota rents. However, this comes at a cost to consumers, who end up paying more for sugar and sugar-based products. Additionally, the reduced competition and limited supply can lead to lower quality goods and fewer choices for consumers.

Another example is the European Union's Common Agricultural Policy (CAP), which includes quotas for various agricultural products. These quotas are designed to protect domestic farmers and ensure food security, but they can also lead to inefficiencies, reduced competition, and even trade disputes. Understanding these case studies can help policymakers, businesses, and consumers make more informed decisions and advocate for fair and equitable trade practices.

Lessons Learned from Quota Rent Case Studies

From these case studies, we can draw several important lessons about quota rents and their impact on various stakeholders. First, quota rents can generate significant profits for producers and traders, but they often come at a cost to consumers, who end up paying higher prices for goods and services. Second, quotas can lead to inefficiencies, reduced competition, and even changes in production patterns, affecting the broader economy.

Third, careful policy design is

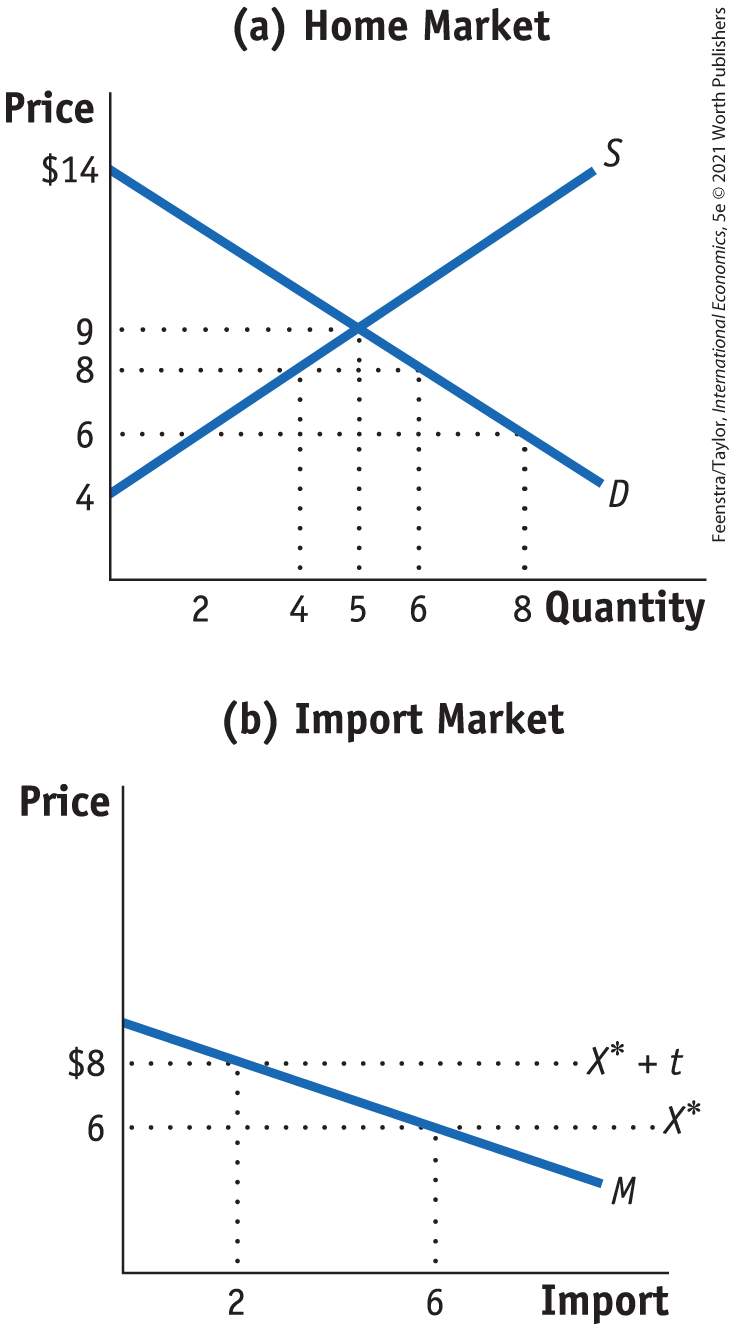

Quota rents with binding outquota tariff Download Scientific Diagram

Quota rents with binding outquota tariff Download Scientific Diagram

Solved Calculate the quota rents earned at Home and the net